The gap between “want” and “buy” has shrunk to the length of a thumb tap. That’s why money experts keep returning to the same deceptively old-school fix: the 30‑day rule, a deliberate pause that puts your future self back in charge of your wallet.

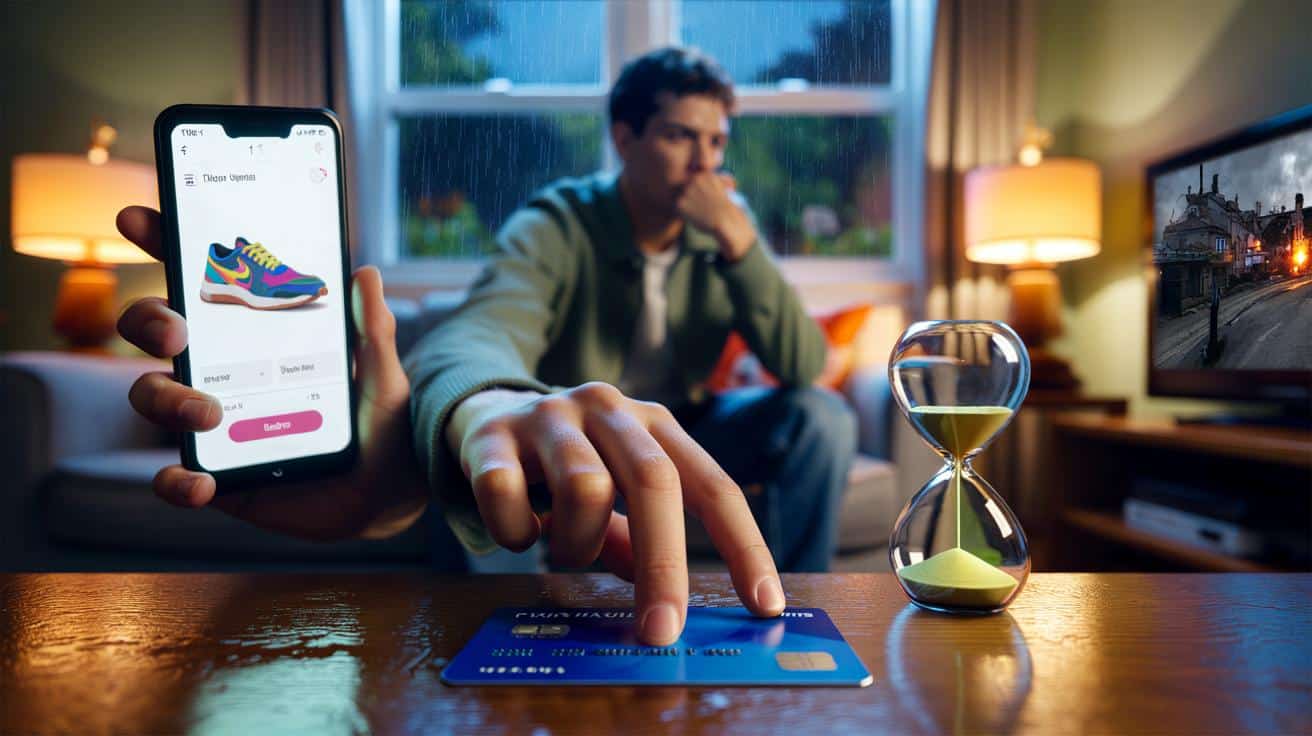

It starts on a rainy Tuesday at 11:43pm. You’re half-watching a crime drama, half-scrolling a feed that knows your weaknesses better than you do. A pair of trainers pops up in a colour that makes your heart skip, the discount clock humming like a wasp. The basket icon winks. Your card sits five inches from your hand, warm as a secret.

You picture wearing them to brunch, to the office, maybe to nowhere at all. The mind does quick acrobatics to turn “nice” into “need”. Your pulse ticks like a metronome. Then a tiny interruption threads the needle: what if I don’t buy it tonight? You breathe. The page waits. So do you. Something shifts.

And the promise is disarmingly bold.

The pause that cools the buy-now reflex

We’ve all had that moment where the thing in the basket feels like the missing piece of a better life. That’s the heartbeat the 30‑day rule targets. **The 30‑day rule is brutally simple: write the item down, wait 30 days, then decide.** No card out. No “just in case”. No checkout. It swaps the sugar rush of buying for the calmer glow of choosing.

The magic isn’t mystical, it’s time. Urgency melts when you see the month unfold: bills, birthdays, rail fares, a boiler that coughs at the worst moment. Take Maya in Leeds, who parked a £189 coat on her “wait list”. At day 18 she realised she wanted warmth, not that brand; a charity shop gem for £22 scratched the itch and left her with money for a weekend trip. The desire didn’t vanish. It redirected itself.

Impulse thrives on present bias — that tug to reward today and leave tomorrow to sort itself out. A 30‑day pause evens the power balance between now-you and later-you. You exit the “hot state” where ads sparkle and your brain leaps for novelty. You re-enter a cooler state where value, not vibes, does the talking. That tiny break lets true priorities surface, and they often look different in daylight.

How to run the 30-day rule without going monk-mode

Here’s the cleanest way to do it. Keep a single “30‑day list” in your Notes app or on the fridge. When a non-essential catches your eye above, say, £25, log it with the date, price, link, and a one-line why. Set a calendar reminder for 30 days later with “decide: yes/no/alternative”. Then forget about it. The forgetting is part of the trick.

There are easy traps. Don’t move the goalposts on day 12 because there’s a “final hours” email. That’s not scarcity; that’s copywriting. Resist the “I’ll order now and decide later” loophole, including buy-now-pay-later. Let sales sit out; if it’s truly essential, it will be essential next month. Let your list be dull and honest, not a mood board. Let’s be honest: nobody does that every day.

When the reminder pings, look at the why you wrote. Does it still stand up? If yes, buy it on a good day with no time pressure and celebrate the choice. If not, cross it off and pocket the win.

“The pause isn’t punishment,” a London financial coach told me. “It’s a boundary with benefits. You’re not saying ‘never’; you’re saying ‘not now, unless it truly matters.’”

- Set a clear threshold (e.g., all wants over £25 go on the list).

- Use one list only, dated and tidy. Decision dates keep you honest.

- Add the reason and where you’ll use it in real life.

- Ban “holding” purchases and BNPL during the wait.

- On day 30, choose: buy, swap for a cheaper alternative, or delete.

Why waiting works when willpower won’t

Willpower is noisy and moody. Systems are quiet. A list and a calendar do what “be stronger” never quite manages after a stressful commute or a late-night scroll. *Your future self is always richer in hindsight.* The 30‑day rule borrows that hindsight and brings it forward, then ties it to action you can repeat.

Behaviourally, you’re creating friction in the right place. Add a couple more smart snags: delete shopping apps from your phone for the month, move autofill and saved cards off your browser, and unsubscribe from the loudest sales emails. **If it still matters in a month, buy it with intention, not adrenaline.** The money you don’t spend becomes a quiet safety net that changes bigger decisions too.

There’s human warmth in this, oddly. Pausing turns spending into a conversation between versions of you, not a lecture. It says, I can want things and still be kind to myself next payday. It fits messy lives, birthdays, cravings, and the odd splurge. It frees you from the heavy feeling of “I should be better with money,” and gives you a light, practical habit instead.

The long view after 30 days

What happens next is almost boring, and that’s the point. Many items simply fade. Some morph into better, cheaper alternatives. A few remain, shining clearly as “worth it” — and you’ll buy them with relief, not jitters. That’s a different kind of dopamine, calmer and longer-lasting.

Over a season, patterns appear. Maybe your midnight wants skew towards comfort, your daytime ones towards status. Maybe your most satisfying purchases are tools, not treats. You’ll spot subscriptions that sounded clever but do nothing, or hobbies that deserve funding because they’re feeding your week. The rule sharpens your taste and your boundaries.

There’s room for exceptions, yes. Essentials don’t wait. Gifts for other people have their own timetable. The spirit of the rule is the pause, not the penalty. Use it to build that small stash that keeps you from panic when the MOT runs high, and lets you say yes to the things that make life feel more yours. Your list becomes a map of what matters — and what doesn’t.

| Point clé | Détail | Intérêt pour le lecteur |

|---|---|---|

| Pause de 30 jours | Note the item, wait a month, decide with a cool head | Fewer regrets, clearer priorities, real savings |

| Friction smart | One list, calendar reminder, no “holding” buys | Makes impulse buying inconvenient, choosing easy |

| Gentle exceptions | Essentials and time-sensitive gifts can skip the wait | Keeps the rule practical and sustainable |

FAQ :

- What exactly counts as an “impulse buy”?Anything non-essential you didn’t plan at least a day before you saw it. If it wasn’t on a list or part of your budget, park it.

- Do I really have to wait the full 30 days during a limited-time sale?You can decide on a shorter window you’ll stick to for sales — 7 days, not 7 minutes. If a deal can’t survive a week, it’s not a deal for you.

- Should groceries and toiletries go on the list?No. The rule targets wants, not needs. Essentials live in your budget. If you’re tempted by premium upgrades, you can still list those.

- What if I forget to check the list at day 30?Perfect. That often means the desire cooled. Set the reminder to repeat weekly until you decide yes/no. If it lingers for 90 days, delete or downsize.

- Is a 24-hour rule just as good?For small spends, 24 hours is handy. For bigger wants, 30 days is where the real clarity lands. Short pause for under £25, long pause for the rest.